Let's say that a Roman Catholic diocese needs to obtain a mortgage loan on its property. And let's also say that times are bad, that unemployment is high, and that the faithful of the diocese might find it hard to keep up regular contributions. That would mean that the diocese could find it difficult to make monthly payments on the loan. The church buildings, representing the security for the loan, are difficult to sell, making a foreclosure on the mortgage impractical. So here is an idea that might come up in the minds of the bank lawyers: have the diocese pledge not only the churches' real estate, but also its "personal property," property that is not real estate.

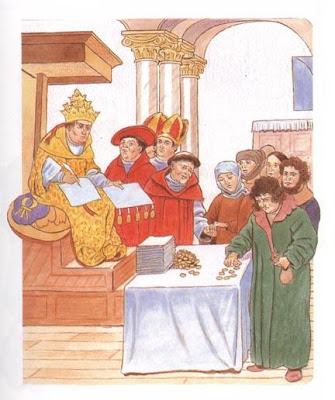

Let's say that a Roman Catholic diocese needs to obtain a mortgage loan on its property. And let's also say that times are bad, that unemployment is high, and that the faithful of the diocese might find it hard to keep up regular contributions. That would mean that the diocese could find it difficult to make monthly payments on the loan. The church buildings, representing the security for the loan, are difficult to sell, making a foreclosure on the mortgage impractical. So here is an idea that might come up in the minds of the bank lawyers: have the diocese pledge not only the churches' real estate, but also its "personal property," property that is not real estate.What sort of "personal property" does a diocese own ? Well, it could always sell indulgences, couldn't it ?

No, of course it could not. Canon law forbids it, and civil law, probably, forbids it also. Most of all, as far as I know, there is no active market in indulgences, so this lack of a market, if nothing else, would make the idea impractical. But before this fact was determined by the mortgage bankers, I think they might well have entertained the idea.

What makes me say this ? Well, I have before me an actual mortgage agreement that mortgage lawyers concocted for a synagogue, in which I find the following:

... which loan shall be secured by a mortgage on the Congregation's premises and a security interest on all items of personal property used at or related to the Congregation's premises ...One of the reasons that lawyers like to use obscure legal terms is that laymen cannot understand them. The hapless congregants of this synagogue approved the language, but how many of them understood that they were mortgaging their sacred Torah scrolls ? As I said, "personal property" means all property that is not real estate. What does a synagogue own in this regard that has value ? Used books, used computers ? Hardly. But Torah scrolls have a market value of between $20,000 and $60,000 each, so in the case at hand the value of the scrolls might be half a million dollars. Furthermore, in case of foreclosure, Torah scrolls are a great deal more marketable than synagogue buildings ...

There is of course a catch to all this, but it isn't a catch that seems to have worried either the mortgage bankers or the congregation's board: Jewish law, halakha, forbids the trafficking in Torah scrolls, sifrei torah. Moreover, even to those who are either not versed in halakha or are fairly indifferent to its many provisions, there is something unusual in this piece of "creative financing" that should have raised red flags. As it happens, the involvement of "personal property" in connection with a real estate loan, especially in the case of synagogues, has so far been unknown.

Now I have to say something that I believe is generally true, but is also no doubt unfair to some honest and hard-working people. This is it: red flags are not popular among creative-finance lawyers. It is said about mortgage bankers (a good many of them), and their lawyers (a good many of these), that they each have one glass eye, and that you can always tell which eye it is because it is the one that inspires more confidence in its owner's probity.